Introduction to Mutual Funds

They are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, money market instruments, or other securities.

A professional fund manager oversees the fund, selecting assets and managing the portfolio to achieve the fund’s stated investment objectives.

Key Terms

Net Asset Value (NAV):

It is the per-share value of a mutual fund, calculated by dividing the total net assets of the fund by the number of outstanding shares.

Fund Size / Assets Under Management (AUM):

It is the total market value of assets that a mutual fund manages on behalf of its investors. (The total amount invested by investors)

Asset Management Company (AMC) / Fund House:

It is the financial institution responsible for managing mutual funds. It hires fund managers, analysts, and other professionals to make investment decisions and manage fund portfolios.

Ex. HDFC AMC, ICICI Prudential AMC, and SBI Mutual Fund

Dividend Plan:

The mutual fund pays out a portion of its profits (from interest, dividends, or capital gains) to investors at regular intervals. These payments are called dividends.

Regular Plan:

The mutual funds sold through intermediaries, such as brokers or financial advisors. The AMC pays a commission to the intermediary, which is factored into the expense ratio.

Ex. Mutual funds bought through banks

Growth Option:

The profits earned by the fund are reinvested back into the fund rather than paid out to investors as dividends.

IDCW (Income Distribution cum Capital Withdrawal) Option:

- It allows for periodic distribution of income to investors in the form of dividends.

- Investors are subject to tax on IDCW payouts, as per the tax slab they fall under, rather than the tax rates for capital gains.

Expense Ratio:

It is the annual fee that the AMC charges investors for managing the fund, expressed as a percentage of the fund’s AUM. This fee covers management expenses, administration, marketing, and operational costs.

Exit Load

- It is a fee or charge imposed by mutual funds or investment funds when an investor decides to redeem or sell their units within a specified period after investment.

- This fee discourages short-term withdrawals and helps fund managers maintain stability by reducing frequent inflows and outflows.

AMC SIP (Direct SIP with Asset Management Company)

It is set up directly with the Asset Management Company (AMC) that manages the mutual fund. This is done through the AMC’s website or mobile app.

Non-AMC SIP (Third-Party or Broker SIP)

It is set up through a third-party platform or broker (such as Zerodha, Groww, or Paytm Money) rather than directly with the AMC. Non-AMC SIPs are often under regular plans, which have higher expense ratios due to broker commissions.

Annual Returns

- It refers to the percentage change in the value of an investment over a one-year period.

- The return is calculated from a specific point in time to the present day.

Rolling Returns

- It refers to a series of annualized returns calculated over a fixed period (like 1-year, 3-year, etc.) but continuously over different time frames. This approach evaluates an investment’s performance in overlapping periods.

- Rolling returns are useful because they smooth out the volatility and provide a better idea of how an investment has performed over time, as they account for different market conditions.

CAGR (Compound Annual Growth Rate/Trailing Returns)

- It represents the mean annual growth rate of an investment, assuming it grows at a steady rate over the period, without accounting for volatility.

- It is only for one time investment

IRR (Internal Rate of Return)

It is a metric used in financial analysis to estimate the profitability of potential investments

XIRR (Extended Internal Rate of Return)

It is a more advanced and accurate method for calculating the rate of return on investments that have irregular cash flows over time, like SIPs (Systematic Investment Plans) or any investment where the timing and amount of cash inflows or outflows are not constant.

Return Distribution (% of times)

It typically refers to the percentage of time a particular range of returns (e.g., -5% to 0%, 0% to 5%, etc.) occurs within the rolling periods being analyzed.

Charges

Brokerage:

A fee charged by the broker (like Zerodha or Upstox) for facilitating buying and selling of securities.

Account Maintenance Charge (AMC):

It refers to the fee that financial institutions, such as banks or brokerage firms, charge customers for maintaining their accounts. These charges are typically levied on services like savings accounts, demat accounts, or trading accounts

Depository Participant (DP) Charges:

Fees collected by the depository participant (broker) for holding securities in an electronic format in your demat account.

Securities/Commodities Transaction Tax (STT/CTT):

A government tax on the purchase and sale of securities like stocks, mutual funds, and derivatives in India.

Transaction/Turnover Tax:

A charge levied on the total turnover of trades done, typically on a daily basis, applicable for day trading.

Goods and Services Tax (GST):

A government tax on the brokerage and transaction fees collected by the broker.

SEBI Charges:

A fee collected by brokers on behalf of SEBI (Securities and Exchange Board of India) to regulate and maintain market security.

Stamp Charges:

A government tax on the transfer of securities in electronic form, applicable at the time of buying stocks.

Demat Debit and Pledge Instruction (DDPI)

- It is a form of authorization that investors can give to their stockbroker, allowing the broker limited access to the investor’s Demat account.

- It is a standardized and convenient alternative to Power of Attorney (PoA), aimed at enhancing security and transparency in managing shares.

Client Unpaid Securities Pledge Account (CUSPA)

It is a mechanism created by stock exchanges and regulatory authorities in India to manage situations where clients have purchased securities (such as shares) but haven’t fully paid for them yet. Under this system, the securities remain in the broker’s or clearing corporation’s CUSPA account, where they’re temporarily pledged until the client completes the payment. This helps ensure transparency and prevent misuse of unpaid securities.

Types of Mutual Funds:

Equity Funds

- They invest primarily in stocks, aiming for higher returns.

- These funds can be higher risk but generally have greater growth potential.

Debt Funds

They invest in fixed-income instruments like bonds or government securities (Gilt/Corporate/Credit risk). These funds are considered safer but generally offer lower returns.

Hybrid Funds

This combines stocks and bonds to balance risk and return. Examples include balanced funds and asset allocation funds.

Index Funds

- It is a type of mutual fund that aims to replicate the performance of a specific market index, such as the Nifty 50, Sensex, or other stock market indices.

- Since index funds are passively managed (i.e., no active stock picking), they have lower expense ratios compared to actively managed mutual funds.

- They are suitable for long-term investors who want to achieve market-average returns without worrying about short-term market fluctuations.

Categories

Flexi Cap Funds

- They are a type of equity mutual fund that invests across market capitalization (large-cap, mid-cap, and small-cap stocks) without any specific restriction on the proportion of investments in each category. – The fund manager has the flexibility to adjust the asset allocation based on market conditions and opportunities.

Multi Cap Funds

- They are equity mutual funds that invest in stocks across different market capitalizations—large-cap, mid-cap, and small-cap stocks.

- However, unlike Flexi Cap funds, the Securities and Exchange Board of India (SEBI) has mandated a specific allocation in each market cap category for Multi Cap funds.

Exchange-Traded Fund (ETF)

- It is a type of investment fund that holds a collection of assets, such as stocks, bonds, commodities, or a mix of these. Unlike mutual funds, ETFs are traded on stock exchanges, just like individual stocks.

- This allows investors to buy and sell ETF shares throughout the trading day at market prices, which can fluctuate during the day.

ELSS (Equity-Linked Savings Scheme)

- It is a type of mutual fund in India that offers both investment growth and tax-saving benefits under Section 80C of the Income Tax Act.

- They have a mandatory 3-year lock-in period

How to choose a Mutual Fund?

1. Compare with the Benchmark

- Check if the fund consistently outperforms its benchmark index (e.g., Nifty 50, Sensex).

- A good mutual fund should deliver higher returns than the benchmark over different time frames.

2. Beta (Risk vs. Market)

- Beta measures the fund’s volatility relative to the market.

- A beta of 1 means the fund moves in line with the market.

Greater than 1 means higher volatility

Less than 1 indicates lower risk.

3. Alpha (Excess Returns)

- Alpha shows how much extra return the fund generated compared to its benchmark.

- Positive alpha indicates the fund manager has added value

- Negative alpha suggests underperformance

4. Standard Deviation (Volatility)

- This measures the variability of the fund’s returns.

- A lower standard deviation implies more stable returns, while a higher one indicates greater risk.

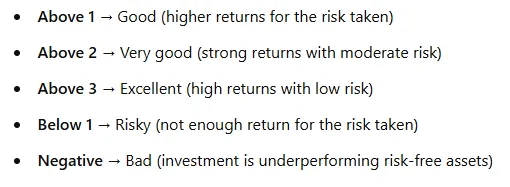

5. Sharpe Ratio (Risk-Adjusted Returns)

- This ratio evaluates returns relative to the risk taken.

- A higher Sharpe Ratio indicates better risk-adjusted performance.

6. Capture Ratio

- Upside Capture Ratio: Shows how well the fund performs during market upswings.

- Downside Capture Ratio: Measures performance during market downturns.

- A good fund will have a high upside capture ratio and a low downside capture ratio.

7. Compare with Category Average

- Compare the fund’s returns with the average returns of similar funds in the same category (e.g., Large Cap, Mid Cap).

- Outperforming the category consistently is a positive indicator.

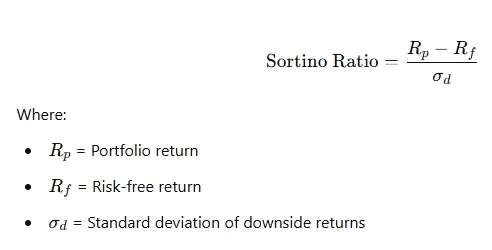

8. Sortino Ratio

- It is a risk-adjusted return metric that measures the excess return of an investment relative to its downside risk. It is similar to the Sharpe Ratio, but instead of using total volatility (standard deviation), it only considers downside volatility (i.e., the risk of negative returns).

- A higher Sortino Ratio is better, indicating higher returns per unit of downside risk.

- A Sortino Ratio above 2 is generally considered good, while below 1 indicates higher risk relative to return.

Rolling Returns

- Look for a fund with average rolling returns of 15% or more over different time horizons (3, 5, or 10 years).

- Rolling returns give a better idea of consistency than point-to-point returns.

Expense Ratio

- Lower expense ratios mean more of your money is invested, translating to better returns.

- Compare expense ratios within the same category to identify cost-efficient options.

Stay Connected!

If you enjoyed this post, don’t forget to follow me on social media for more updates and insights:

Twitter: madhavganesan

Instagram: madhavganesan

LinkedIn: madhavganesan