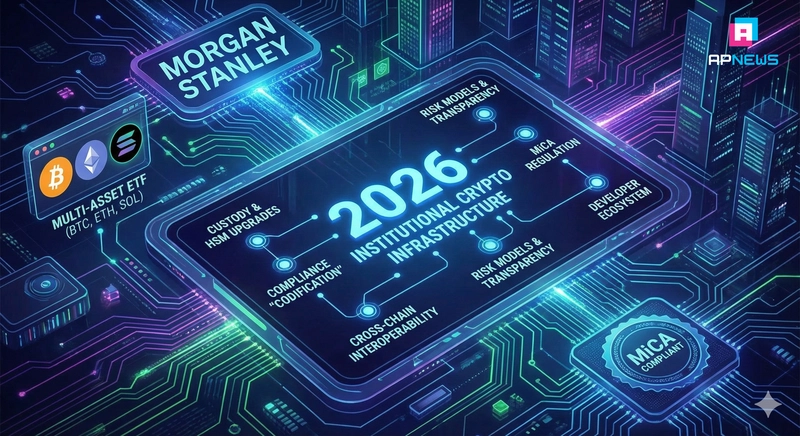

From Morgan Stanley to MiCA: The Technical Reconstruction of Institutional Crypto Infrastructure in 2026

The news emerging in early 2026 sent ripples through the crypto world far beyond what appeared on the surface—Morgan Stanley formally submitted regulatory filings for a multi-asset ETF covering Bitcoin, Ethereum, and Solana. This was not merely another announcement of a Wall Street giant entering crypto, but the prelude to a profound technological transformation. When traditional financial institutions managing trillions of dollars attempt to incorporate blockchain-based assets into their rigorous financial systems, the obstacles they face are not primarily regulatory, but rather deeper technological discontinuities. Every layer of existing financial infrastructure—from custody and settlement to risk management, from audit trails to compliance monitoring—must be fundamentally restructured to accommodate the unique properties of crypto assets. What appears to be a financial-sector contest is, in reality, catalyzing an infrastructure-level technological revolution.

A Paradigm Shift in Custody Systems

Traditional financial custody relies on centralized systems, with ownership recorded in private databases and transfers executed via closed networks like SWIFT. Cryptocurrencies differ fundamentally: ownership is mathematical—private keys equal ownership—and transactions are validated by decentralized networks on public ledgers, creating architectural incompatibility. Institutions like Morgan Stanley therefore need entirely new technology stacks that meet both traditional compliance and blockchain requirements. Multi-signature wallets are evolving into multi-party computation (MPC), where private keys never exist fully and signatures are collaboratively generated, improving security and efficiency while addressing risks like collusion or node failure, with zero-knowledge proofs and trusted execution environments emerging as standards.

Hardware security modules (HSMs) are also advancing to support complex cryptography, secure hot wallet interaction, and evolving blockchain protocols, with secure channels ensuring transaction legitimacy, preventing replay attacks, and verifying compliance before signing. Together, these innovations are reshaping custody, security, and operational infrastructure for institutional crypto adoption.

The Technical Implementation of Compliance Automation

Europe’s MiCA framework sets 2026 technical standards for crypto service providers, requiring real-time monitoring, client fund segregation, and transparent audit reporting to be implemented in code. “Regulation as code” uses smart contracts to automate compliance, such as requiring multiple authorized signatures for large transfers, enforcing time-based limits, and recording audit trails. On-chain AML monitoring leverages graph databases and privacy-preserving techniques like homomorphic encryption and zero-knowledge proofs to detect suspicious activity without compromising transaction privacy. Together, these innovations redefine compliance, financial privacy, and system architecture for institutional crypto adoption.

A Unified Technical Layer for Multi-Asset Management

Morgan Stanley’s multi-asset ETF highlights the complexity of multi-chain management, as Bitcoin, Ethereum, and Solana differ in consensus, smart contract languages, and security models. Institutions need a unified abstraction layer for consistent asset management, driving cross-chain interoperability from simple bridges to state verification using light-client proofs and zero-knowledge proofs. Risk models must also evolve, integrating on-chain data, network, governance, and technical risks, while adapting dynamically to blockchain innovations through real-time monitoring and self-adjusting systems.

The Demand for Technical Transparency in Yield Strategies

Institutional investors are highly interested in “non-selling yield strategies,” but demand strict technical transparency. Early cloud mining or staking services were criticized as black boxes, while new solutions use cryptography and distributed systems to address trust. Verifiable computation, through zero-knowledge proofs or trusted execution environments, allows providers to prove correct operation—such as validator node activity—without revealing sensitive details, shifting trust from institutions to code and mathematics. Open-source financial strategy frameworks further enhance transparency, enabling developers to audit logic, verify models, analyze performance, and support independent third-party audits, reducing information asymmetry, fostering innovation, and meeting institutional due diligence standards.

The Evolution Map of the Developer Ecosystem

Institutional crypto adoption is creating entirely new developer opportunities and skill requirements. Traditional fintech developers must deeply understand blockchain’s unique properties, while crypto-native developers must master complex financial compliance. This cross-domain demand is opening distinctive market opportunities and career paths, with the 2026 tech talent market seeing accelerated convergence. Open-sourcing compliance tools is emerging as a clear trend: developer communities are building universal modules—KYC verification, transaction monitoring, regulatory reporting, and tax calculation—that integrate across crypto platforms, reduce implementation costs, enhance interoperability, improve code security through community review, and provide regulators with transparent oversight.

The development of institutional-grade API standards is also becoming an industry focal point. Crypto markets need unified API specifications covering custody, trade execution, market data, and risk reporting, enabling seamless integration and reducing costs for institutional adoption. Standardization is prompting traditional financial IT providers to rethink product roadmaps and incorporate crypto functionality. Meanwhile, high-fidelity testing and simulation infrastructure is critical for deployment, allowing institutions to model market conditions, network states, and attack scenarios, perform stress tests and audits, and backtest strategies on historical data. These capabilities reduce operational risk, improve reliability, and are essential for large-scale institutional adoption.

Forecasts and Outlook for the 2026 Technology Horizon

Over the next 12–18 months, several trends will shape institutional crypto adoption. The maturity of cross-chain interoperability protocols will determine whether multi-asset management is practical, with leading solutions expected by the end of 2026 to meet institutional standards for reliability, security, and performance. Advances in privacy-preserving technologies will resolve the tension between compliance monitoring and individual privacy, while more efficient zero-knowledge proofs may become standard tools, enabling regulatory compliance without compromising user confidentiality.

Deep integration of regulatory technology and blockchain could give rise to “programmable regulation,” where standardized smart contracts automatically enforce compliance while regulators monitor activity in real time. This requires regulators to enhance technical capabilities and collaborate closely with developer communities, potentially creating new governance models that balance regulatory certainty with innovation. Open-source culture and traditional finance’s closed systems may converge in hybrid architectures—core infrastructure open for transparency and security, while upper-layer applications remain closed to protect competitive and customer data. Striking this balance will define 2026’s crypto-financial technology landscape and shape finance’s technical foundation for the decade ahead.

The Chain Reaction of Technical Reconstruction

Morgan Stanley’s multi-asset ETF application may appear as an isolated event, but it is in fact a catalyst for a broader reconstruction of financial infrastructure technology. Each such institutional move accelerates solution maturity, drives standard formation, and reshapes developer skill requirements. The impact of this reconstruction will extend beyond crypto assets, potentially transforming the underlying architecture of traditional finance. When Wall Street trading systems begin directly interfacing with blockchain networks, when regulatory rules are encoded as executable smart contracts, and when risk management models analyze on-chain data in real time, what we witness is not merely acceptance of a new asset class, but a re-laying of the technological foundations of the entire financial system. This process is fraught with technical challenges, yet it creates unprecedented opportunities for innovation. For the technology community, understanding the logic of this reconstruction, identifying innovation inflection points, and participating in standard-setting and tool development will be critical to maintaining leadership in 2026 and beyond.

Ultimately, technology not only serves financial innovation, but reshapes the foundations of trust and value flow in finance—this is the most profound transformation blockchain technology brings to the financial system.